Align incentives, manage your roadmap, track progress and pay out rewards with a tool that connects benefits to actual value contributed

Minimize cash need

Boost engagement

Reward with profit entitlements

Tailor compensation

Shorten time to market

Keep voting control

No notary deed for issuance

100% digital

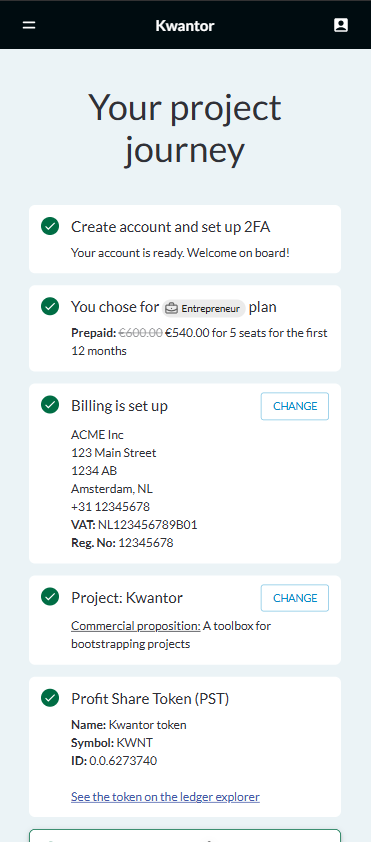

We'll guide you through the process of creating your project, inviting contributors and creating and signing robust contracts. This is the first step in structuring your project on Kwantor.

Get startedReward contributors with Profit Share Tokens to balance direct rewards with long-term benefits

Grow your project assets financed through profit entitlements to reduce costs while remaining in control

You are going to use Profit Share Tokens (PSTs) as compensation for labor and investments, entitling holders to a share of profits.

Let's say you are a food-lover and invented a delicious lemonade recipe.

To test product–market–fit, you plan to operate a lemonade stand at a large three-day fair. Two friends, Alice and Bob, will help you make lemonade and decorate the stand.

Initial Investments

€500 for stand and day 1 supplies, plus €480 labor budget: €980 paid by you

Additional ingredients: €200 paid by Alice

Total initial cash: €1,180

Compensation Agreement

Each works 24 hours

Alice & Bob: €10/hour + 15 PSTs/hour

You: 25 PSTs/hour, no cash

Investments rewarded at 1 PST=€1

Profits distributed pro rata to PST holdings

Compensation Calculation

You:

Cash – none

€0

Labor PSTs – 24 h × 25 PSTs/h

600 PSTs

Investment PSTs – €980

980 PSTs

Total PSTs

1,580 PSTs

Alice:

Cash – 24 h × €10/h

€240

Labor PSTs – 24 h × 15 PSTs/h

360 PSTs

Investment PSTs – €200

200 PSTs

Total PSTs

560 PSTs

Bob:

Cash – 24 h × €10/h

€240

Labor PSTs – 24 h × 15 PSTs/h

360 PSTs

Profit Entitlements

Total PSTs issued: 2,500.

Profit shares:

You — 1,580 PSTs

63%

Alice — 560 PSTs

22%

Bob — 360 PSTs

14%

Fair Outcome

The fair is a massive success. You sell lemonade at €4 per cup and sell 1,000 cups, earning €4,000 in revenue.

You pay Alice and Bob their cash compensation of €240 each, using the €480 you put up for that.

Now it is time to distribute the earnings (€4,000) and calculate your profits.

Profit Distribution (by PST share)

You

63% of €4,000

€2,528

Less investment €980

−€980

Net profit

€1,548

Alice

22% of €4,000

€896

Plus cash €240

€240

Less investment €200

−€200

Net profit

€936

Bob

14% of €4,000

€576

Plus cash €240

€240

Net profit

€816

So what does this mean?

✅ Using PSTs allowed you to drastically reduce your cash need

✅ It allowed you to create assets without taking on debt

✅ You were able to optimize engagement

✅ You didn’t need to go to a notary to use a robust profit sharing instrument

Note that, in this scenario, Alice and Bob earned more than if they had been paid in cash only, as they received a share of the profits.

This is a win-win situation for everyone involved.

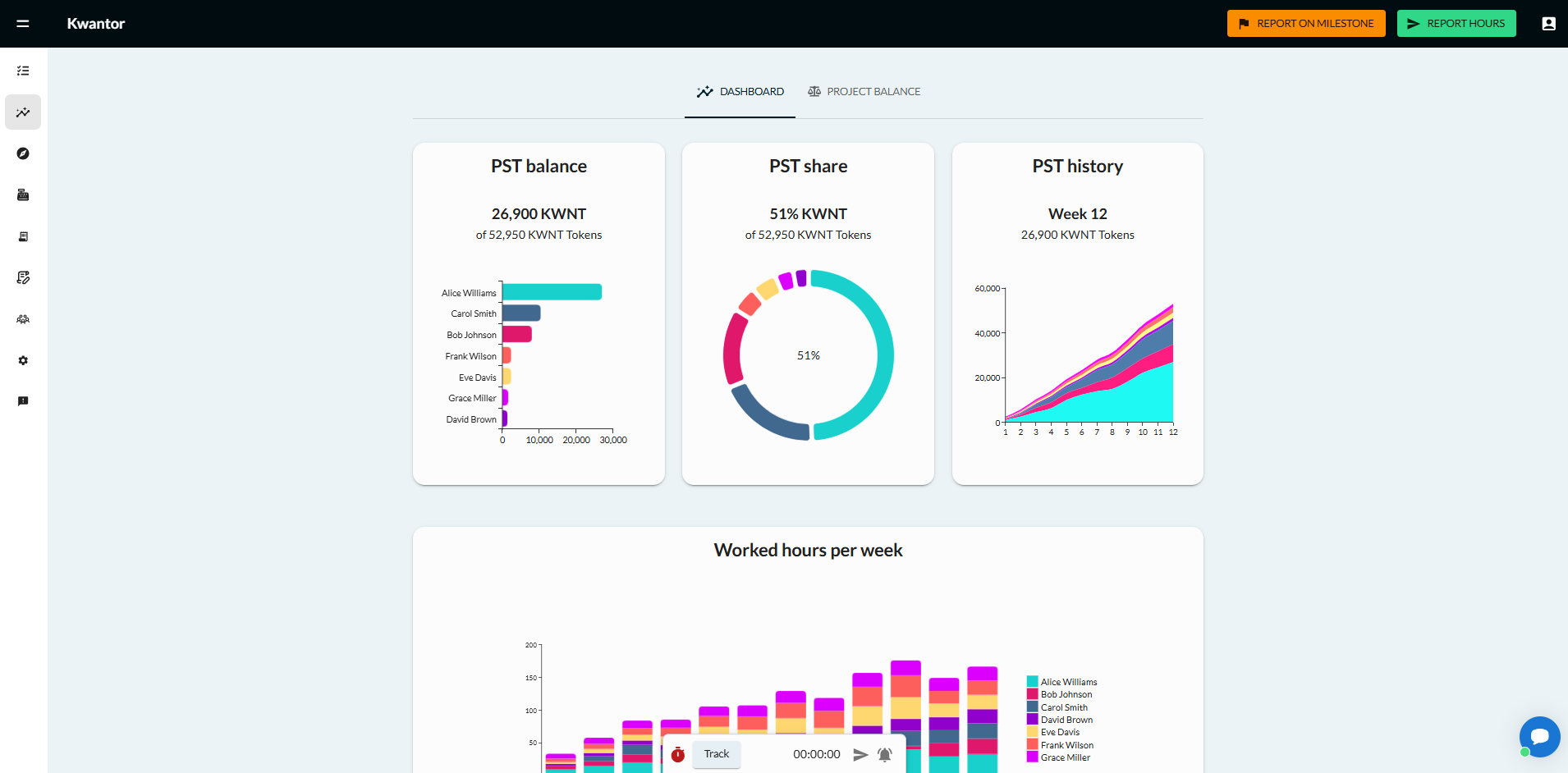

Project Balance

As of 2025-12-15Cash-paid assets

1180

Profit entitlement (PST)-paid assets

1320

Available cash balance

4000

Total Assets

6500

Capital contribution against profit entitlements (PSTs)

2500

Retained Earnings (accumulated profits from revenue)

4000

Total Equity

6500

Bootstrap your project and reward your team fairly with Profit Share Tokens. Our contract models let you get started quickly.

Minimize upfront capital

Reward early contributors

Fast digital setup

Pre incorporation

Get started quickly

Boost engagement with Profit Share Tokens by rewarding your team with a stake in the business. We connect you with a notary, ensuring a smooth process.

Boost engagement

Align rewards to KPIs

Maintain governance control

Maximize team performance

Billing period

Set up a Sandbox project to discover Kwantor and use all functionalities — entirely free.

Price per user per year

You are self-employed and want to develop your proposition. Suitable if you're not seeking to set up a legal entity (yet)

Price per user per year

€120

€108/ySet up a new business entity for your proposition and harness the power of Kwantor. We’ll connect you with a notary

Price per user per year

€300

€270/yBilling period

Price per user per year

€120

€108/yMembers to include:

You will be billed:

We will connect you to a notary that knows our contract models

100% online

Starting from

We want to reward you for helping us grow the Kwantor community

Refer your entrepreneurial friends and colleagues to Kwantor and earn a percentage of their first-year annual spend on a Kwantor Entrepreneur plan. The more you refer, the more you earn! And your referrals will also get an extra 10% discount on their first year subscription.

Only eligible entrepreneurs with a valid Dutch VAT registration may participate. Terms & conditions apply.of your referral's first-year annual spend on a Kwantor Entrepreneur plan

1st

10%

2nd

15%

3rd

20%

4th

25%

5th

30%

6th

35%

7th

40%

8th

45%

9th

50%

10th

55%

for the referred user on their first year subscription

That's on top of the 10% discount for their annual subscription!

Profit entitlements are rights granted to an individual or entity to receive a specified share of a project’s profits.

Profit Share Tokens are tokens that function as accounting unit for profit entitlement. Their technological robustness, efficiency and contractual embedding ensure that they can replace traditional profit shares in a secure and transparent manner.

Regular shares usually combine voting rights and profit rights and require a notary deed for issuance. Profit Share Tokens are only linked to profit rights (not voting rights) and do not require a notary deed for issuance.

No—Profit Share Tokens qualify as regular securities. Similar to cryptocurrencies, they do leverage distributed ledger technology for robustness and efficiency.

Yes—you can create a project with a Sandbox that is entirely free. You can invite others as well, or just explore it by yourself

Chat and email support is included in all plans.

Yes—EU citizens can use our model contracts, which apply Dutch law and designate Amsterdam courts for disputes. Enforcement abroad depends on the other country’s recognition rules. Consult a legal professional if in doubt.

Yes—non-Dutch citizens can generally set up a BV. For the notary deed, a notary may require your personal appearance or accept a signed power of attorney at their discretion.

Start rewarding your team today

Leverage the power of Kwantor to bootstrap your project and boost your team's engagement.